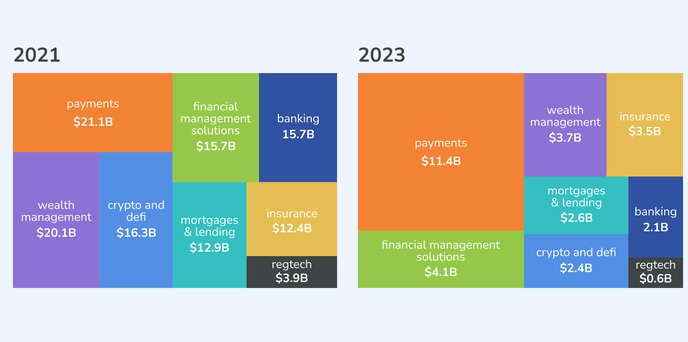

Fintech investments surged in 2021, but funding declined sharply in the following two years. Fintech investments fell by -63% in 2023 , making it the worst year in terms of funding since 2017. Fortunately, the correction will soon be floored and the fintech industry will recover in 2024, but companies will have to work harder to secure funding.

F-Prime’s “State of Fintech 2024” report called 2023 a “regulation on, risk off” year amid market pressure and regulatory scrutiny. Funding is on the rise again, but investors are looking for regulatory compliance and a stronger track record of growth from fintech ventures.

Here are seven fintech marketing strategies to generate the growth investors want in 2024.

Top Fintech Marketing Issues for 2024

Fintech marketers will need to recalibrate their goals to adapt to current market challenges after 2023 saw the worst global investment slump since 2017. Fintech’s honeymoon period for Wall Street is over, as regulatory scrutiny, closures and a clear lack of profitability have poured cold water on investors.

The biggest challenges facing fintech marketers in 2024 are:

- Market Correction: With fewer rounds and longer periods between rounds, securing capital has become a major challenge for fintech businesses. F-Prime’s “State of Fintech 2024 Report” warns that “significant operational closures are likely in 2024 and 2025,” highlighting the importance of allocating resources and budgets effectively.

- The Deal: Apart from a 64% drop in VC funding in 2023 , the payments sector now accounts for the majority of fintech investments, meaning other sectors get a smaller share from less funding.

- Competition: Financial giants have weathered major disruptions from startups and, in most cases, emerged stronger than ever. Meanwhile, fintech is no longer the hottest commodity on Wall Street as investors turn their attention to AI .

- Regulation: Regulatory scrutiny of fintechs is set to intensify in 2023, particularly in the US , contributing to the “regulation on, risk off” summary in the F-Prime report.

- Investor Watch: As market and industry challenges intensify, investors are putting their capital towards “safer” ventures that demonstrate true sustainable profitability rather than short-term growth.

- Customer loyalty: Even in traditional banking and finance, there has been a surge in churn as customers seek providers that better fit their needs . To achieve the sustainable growth that investors demand, fintech startups need to understand their ideal customer profile (ICP), tailor their products/services and fintech marketing campaigns to them, and retain them throughout the customer lifecycle.

The good news for fintech marketers is that the market correction will level out in 2024. F-Prime says that “the fintech market is on track to recover heading into 2024,” and McKinsey predicts that “Fintech revenues will grow nearly three times faster than the traditional banking sector between 2023 and 2028.”

But regaining investor confidence won’t be easy. F-Prime acknowledges that investors are prioritizing high-performing fintech ventures, especially those with high gross margins. Fintech marketers need to abandon their growth-at-all-costs mentality and switch to a data-driven optimization, growth and revenue system.

7 Fintech Marketing Strategies

Given the current state of the fintech industry and relatively low investor confidence, the priority for fintech marketers should be to build a new culture of sustainable profits, which starts with rethinking priorities and shifting marketing goals to reflect longer-term ambitions.

Here are the most important fintech marketing strategies for 2024.

1. We prioritize profitability over growth.

To move away from the obsession with growth, fintech marketers need to optimize for different KPIs. Instead of flipping metrics like customer growth rates, fintech companies need to take a more balanced approach to measuring sustainable profitability.

This means acquiring new customers while retaining and maximizing the value of existing ones. It also means focusing on targeting the most valuable prospects, rather than trying to target everyone, even if that means a smaller overall user base.

Optimizing profitability starts with putting vanity metrics in their place and pinpointing the KPIs that show valuable business growth:

- Gross Profit Margin

- Sales Growth Rate

- Cash Flow

- Monthly active users (users who complete a transaction are considered “active”)

- Customer Acquisition Cost

- Customer Retention

- Customer Lifetime Value

- Average Revenue per User

- Average number of monthly transactions

- Average Transaction Value

A more focused customer acquisition strategy can incorporate these insights at every company level, for example, in product development and customer experience (CX) to prioritize customer engagement, revenue, retention and customer service.

To ensure all your marketing efforts are working towards these KPIs, you need an attribution system that accurately measures each channel’s contribution.

Marketing attribution (aka multi-touch attribution) should be used to measure every touchpoint in the customer journey and accurately credit them for driving revenue, allowing you to allocate the right budget to channels and campaigns that add real value to your business (e.g. social media marketing vs content marketing).

Example: Mastercard helps digital bank acquire 10 million high-value customers

For example, Mastercard helped a digital bank in Latin America achieve sustainable growth beyond customer acquisition : The fintech wanted to increase revenue through targeted customer acquisition and profitable engagement metrics.

Strategies include:

- Targeted acquisition strategy for high-value customers

- Increase in average customer spending

- Reduce customer acquisition costs

- Customer Retention

As a result, Mastercard advisors helped the fintech acquire 10 million new customers in two years, and more importantly, increased customer spending by 28% while reducing customer acquisition costs by 13%, creating a more sustainable, profitable growth model.

2. Use web and app analytics to motivate users before they abandon

Engagement is key to customer retention and lifetime value, so to prevent valued customers from churn, you need to intervene when they show early signs of losing interest but are still receptive to your incentive tactics (promotions, rewards, milestones, etc.).

By integrating web and app analytics, you can identify churn patterns and pinpoint the series of behaviors that lead to abandonment. For example, you might determine that customers who only log in once a month, use one dashboard, or have below a certain transaction rate are at high risk of churn.

Using a tool like Matomo for your web and app analytics can help you detect these early signs of churn. Once you identify the risk of churn, you can create triggers to run automated re-engagement campaigns. You can also personalize campaigns using CRM and session data to directly address the causes of churn, for example with valuable content or incentives to increase conversion rates.

Example: Dynamic Yield’s Fintech Re-Engagement Case Study

In this Dynamic Yield case study , a leading fintech company used customer spending patterns to identify those most likely to churn. They set up automated campaigns with personalized in-app messages and time-bound incentives to boost transaction rates.

With a fully automated re-engagement campaign, the fintech company improved customer retention through valuable engagement and actions that drove revenue.

3. Identify the paths your most valuable customers take

Why optimize the web experience for everyone when you can customize the online journey for your most valuable customers? Use customer segmentation to identify the interests and habits your most valuable customers have in common. You can learn a lot about your customers from the pages and content they visit before taking action.

Use these insights to optimize your funnel to motivate prospects who exhibit the same customer behavior as your most valuable customers .

Get 20-40% more data with MatomoOne

of the biggest issues with Google Analytics and many similar tools is that they produce inaccurate data due to data sampling: once you collect a certain amount of data, Google reports estimates instead of giving you complete and accurate insights.

This means you may be making important business decisions based on inaccurate data. And at a time when investors are nervous about the uncertainty surrounding fintech, the last thing they want is inaccurate data.

Matomo is a reliable and accurate alternative to Google Analytics that doesn’t use any data sampling . It gives you 100% access to your web analytics data so you can make every decision based on insights you can trust. With Matomo you get access to 20% to 40% more data than with Google Analytics.

With Matomo you can confidently get a complete picture of your marketing efforts and provide trusted insights to potential investors.

4. Reduce onboarding drop-off with marketing automation

Onboarding drop-off means you miss out on a return on your customer acquisition costs, and you miss out on building long-term relationships with users who never complete the onboarding process.

The onboarding process also determines the customer’s first impression and sets the precedent for their ongoing experience.

An engaging onboarding experience will convert more potential customers into active users, leading to repeat engagement and valuable actions.

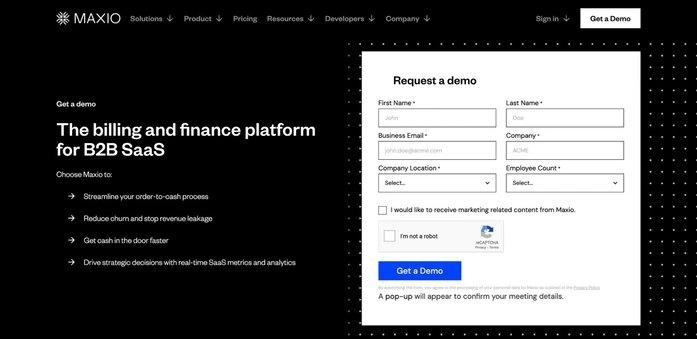

Example: Maxio reduces onboarding time by 30%

with GUIDEcx Onboarding optimization specialist GUIDEcx managed to reduce Maxio’s onboarding time by 6 weeks.

Compressed onboarding timelines led more customers to commit during the kickoff call, while by increasing automated tasks by 20%, the company increased capacity by 40%.

5. Increase the value of TTFV with personalization

Time to First Value (TTFV) is a key metric for onboarding optimization, but some actions are more valuable than others. Personalizing your new users’ experience can increase the value of their first action and motivate them to continue using your fintech product/service.

The onboarding process is your opportunity to get to know your new customers better and deliver the most rewarding user experience for their specific needs.

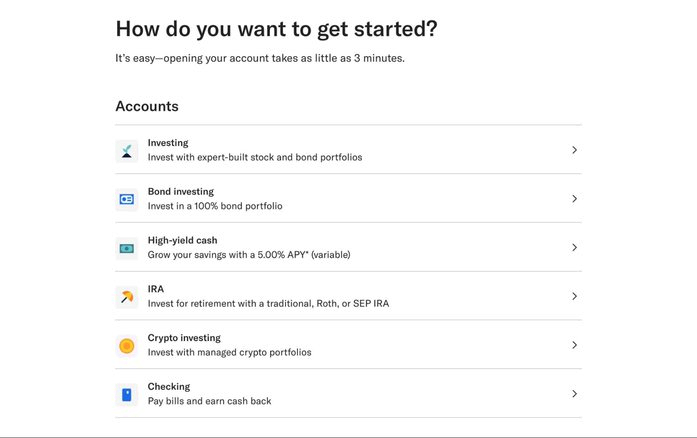

Example: Betterment helps users get their money in front of their eyes.

Instead of the typical email sign-up process, Betterment introduced a quick, personalized onboarding system. The app wants to help new customers optimize their first transaction during onboarding and get their money in front of them right away.

We provide a personalized experience by encouraging new members to choose their goals, set up the right accounts, and select the portfolio that best suits them. They can complete their first investment within minutes, and expert financial advice is just a click away.

Optimize your account opening with Matomo

To create and optimize a sign-up process like Betterment’s, you need an analytics system with a complete conversion rate optimization (CRO) toolkit.

Matomo includes all the CRO features you need to optimize user experience and increase sign-ups : heatmaps, session recordings, form analytics and A/B testing allow you to make data-driven decisions with confidence.

6. Use gamification to drive product engagement

Gamification can create a more engaging experience and motivate customers to continue using your product. The key is to reward valuable actions, engagement time, goal achievements, and smaller goals that lead to bigger achievements.

Gamification is most effective when it is used to help individuals achieve goals they set for themselves , rather than the goals of others (e.g. their employers) . This helps explain why gamification is so valuable to fintech experiences, and how effective gamification can be implemented into products and services.

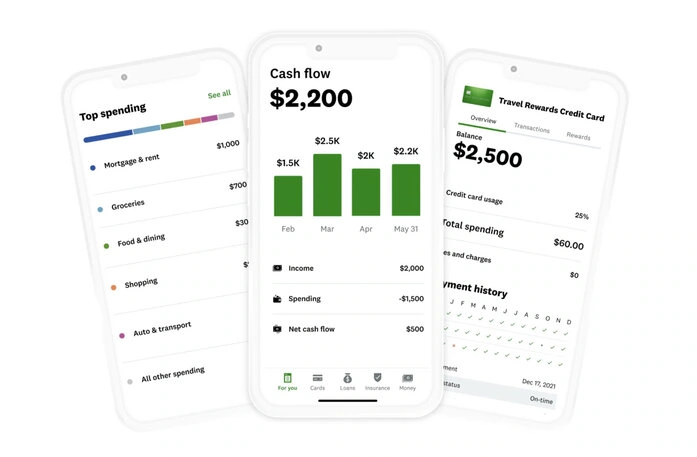

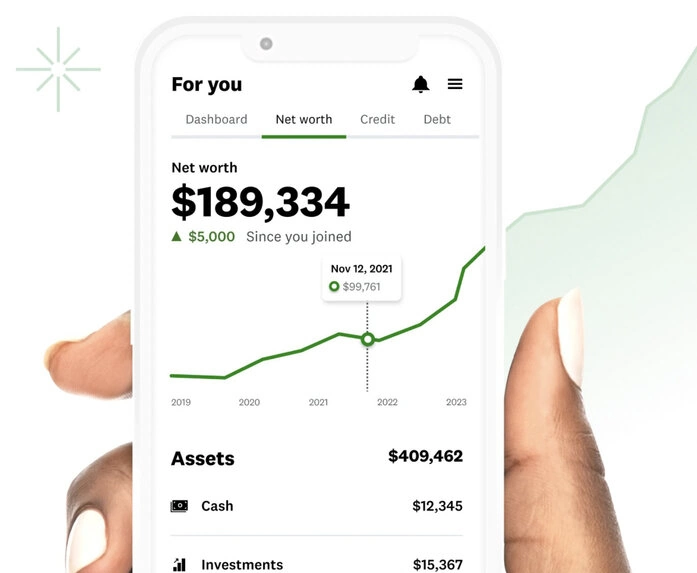

Example: Credit Karma gamifies personal finance

Credit Karma helps users improve their credit and build net worth, and subtly gamifies the entire experience.

Users can set financial goals, link all their accounts and track their assets in one place. The app helps users “Watch Your Wealth Grow” by showing how assets, liabilities and investments all contribute to your next wealth, all in one easy to track number.

7. Personalize your loyalty programs to increase retention and CLV

Loyalty programs use similar psychology to gamification to increase engagement and provide rewards, with the key difference being that, generally, instead of earning rewards themselves, they directly reward customers for their long-term loyalty.

That said, you can also introduce elements of gamification and personalization into your loyalty program.

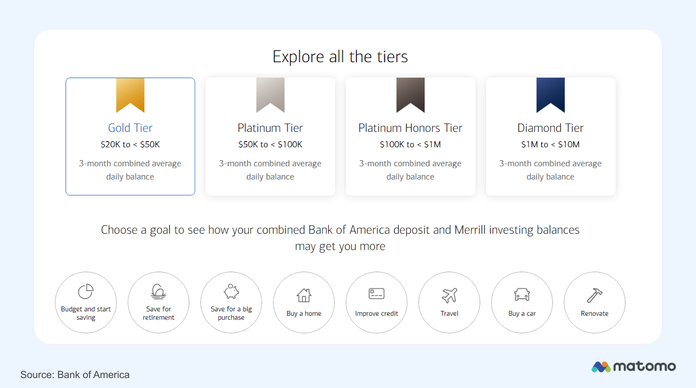

Example: Bank of America Preferred Rewards

Bank of America’s Preferred Rewards program employs a tiered rewards system that rewards customers based on their total spending, savings and borrowing.

The program provides incentives for all banking customers, increasing rewards for the most active customers. Customers can also set personal financial goals (e.g. saving for retirement) and see which rewards will give them the most value.

Conclusion

Fintech marketing must keep up with new investor priorities for 2024. The pre-pandemic buzz is over, and investors remain cautious amid increased regulatory scrutiny, numerous security breaches and a stalled market recovery.

To win the trust of investors and consumers, fintech companies must abandon their growth-first mentality and adopt a marketing philosophy focused on long-term profitability — something investors want in volatile markets, and no doubt customers want from companies that handle their money.

Get a complete picture of your marketing efforts with Matomo’s powerful features and accurate reporting. Trusted by over 1 million websites, Matomo is the choice for compliance, accuracy and powerful features that drive actionable insights to improve decision-making.